Succeed with US Hispanic gamers

Captivate and delight US Hispanic mobile gamers5 principles to engage players in an overlooked marketHere at Google Play, we recognize the importance of US Hispanics, a demographic often overlooked when creating games for Latin Americans. We also know there is a lack of developer-focused research about what motivates US Hispanic gamers, particularly compared to other Latin American gamers. To address this, we collaborated with market research and advisory company Savanta to survey Latin American and US Hispanic gamers. The goal was to understand key gaming behaviors and experiences, engagement drivers, and spending behavior in these markets.Over 10 thousand people responded, including US Hispanic gamers and gamers from Mexico, Colombia, Chile, and Peru. The gamers who responded were aged 18 to 45; 56% were male and 44% female. We also found that when it came to US Hispanic gamers:62% identify as Mexican, Mexican American, or Chicano.51% speak Spanish. 14% speak mostly or only Spanish,

Captivate and delight US Hispanic mobile gamers

5 principles to engage players in an overlooked market

Here at Google Play, we recognize the importance of US Hispanics, a demographic often overlooked when creating games for Latin Americans. We also know there is a lack of developer-focused research about what motivates US Hispanic gamers, particularly compared to other Latin American gamers. To address this, we collaborated with market research and advisory company Savanta to survey Latin American and US Hispanic gamers. The goal was to understand key gaming behaviors and experiences, engagement drivers, and spending behavior in these markets.

Over 10 thousand people responded, including US Hispanic gamers and gamers from Mexico, Colombia, Chile, and Peru. The gamers who responded were aged 18 to 45; 56% were male and 44% female. We also found that when it came to US Hispanic gamers:

- 62% identify as Mexican, Mexican American, or Chicano.

- 51% speak Spanish. 14% speak mostly or only Spanish, and 37% speak Spanish and English equally.

- 42% consume some media in Spanish. 33% consume media in Spanish and English equally, and 9% in mostly or only Spanish.

- 87% were born in the US.

From these gamers, we identified 5 principles that could help mobile game studios captivate and delight US Hispanic mobile gamers. This article explores these 5 principles, showing how US Hispanic gamers differ from or are similar to Latin American gamers. And, for studios that haven’t yet considered how to engage with Latin American gamers, these insights are a great introduction to these gamers generally.

Principles for engaging with US Hispanic gamers

The 5 principles that could help increase US Hispanic gamers’ enjoyment of games, keep them engaged, reduce uninstalls, and interest them in spending are:

- Ensure your game performs exceptionally well

- Use motivations to keep players engaged

- Consider the broader context of gaming sessions

- Ensure a presence across the discovery journey

- Understand local purchase drivers and barriers

Principle 1: Ensure your game performs exceptionally well

3 key things stood out in terms of game performance: game size, uninstall behavior, and model-specific optimizations.

Game size

Game size is the 2nd highest download driver among US Hispanic and Latin American players and higher for 35- to 45-year-olds.

Uninstall behavior

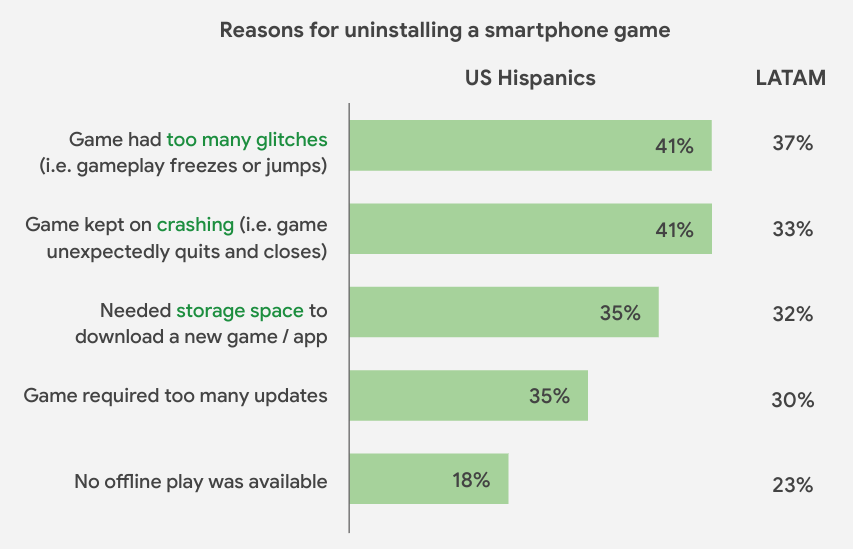

When it comes to uninstalls, poor game quality and crashes are significant drivers of uninstalls for US Hispanic and Latin American gamers.

Model-specific optimizations

Eighty percent of US Hispanic players would download a game if one or more game features are optimized for the hardware characteristics of their smartphone model. Here are the top 5 in-demand features for optimizing game performance:

- Ability to hide skins or cosmetic items unless specific visual packs are downloaded.

- Ability to fully unlock other game modes using additional, optional downloads.

- Ability to download maps one by one or as you progress.

- Lighter textures.

- Lower quality sounds.

Best practices

To address the needs of US Hispanic players, consider:

- Building for quality.

- Minimizing your game size, even when targeting higher spec phones.

- Optimizing game performance by offering options, such as downloads for additional features, that help improve game quality.

Principle 2: Use player motivations to keep them engaged

Tapping into people’s intrinsic motivations for gaming is a great way to find success. We identified four key motivations: the motivation to play, motivation to remain engaged, social motivations, and cultural relevance.

Motivation to play

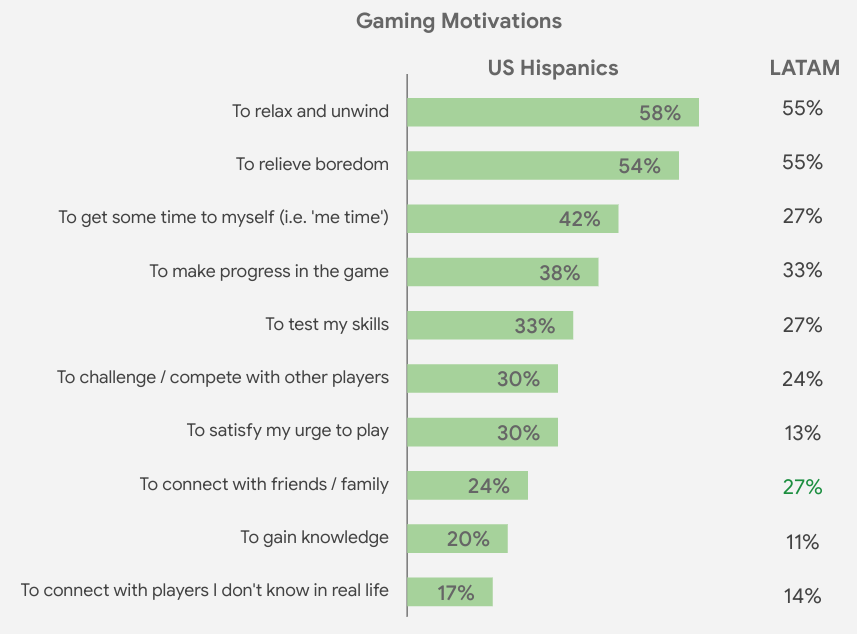

Latin American and US Hispanic gamers are highly motivated to play games to relax, unwind, and relieve boredom. However, US Hispanic gamers are more interested in moments of indulgence and mastery — “me time” — whereas Latin American players have more social motivations.

Motivation to remain engaged

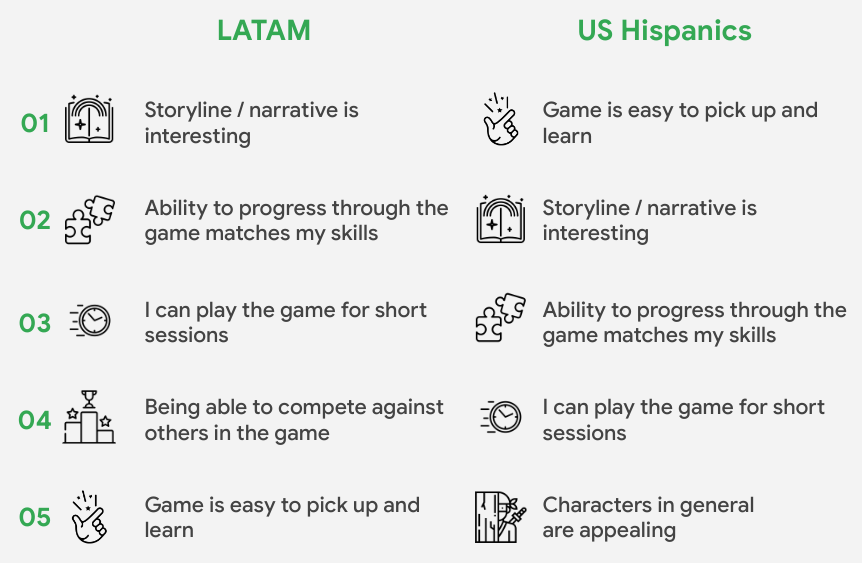

There are strong similarities between the two markets. However, US Hispanic gamers put more emphasis on how easy a game is to pick up and learn compared to Latin American gamers, who are more interested in the game’s story and narrative. Interestingly, only Latin American gamers mentioned the ability to play with others in-game as a top 5 factor that drives engagement.

The top reasons for remaining engaged were:

Social motivations

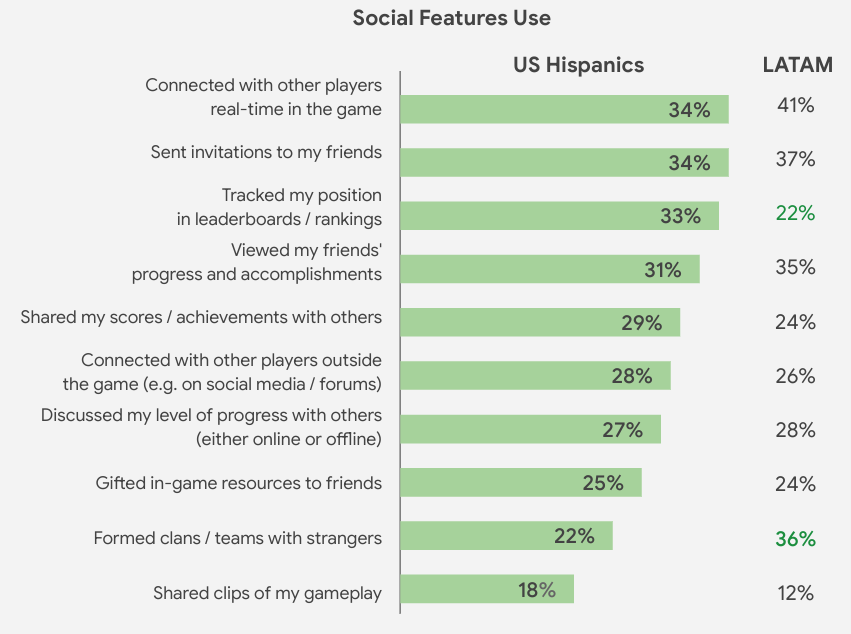

While social reasons aren’t necessarily what drive US Hispanic gamers, there is a significance to social features in their gameplay. When we explored how players engage with and appreciate in-game social features we found that Latin American gamers focus much more on the collective aspects of social gaming whereas US Hispanic gamers focus more on competitive elements:

Cultural relevance

US Hispanic gamers in particular show an appreciation of meaningful localization. Half of the players indicated that they look for storylines and events or characters that are relevant to their culture. And when asked to rank the factors that affected their choice of games to play, the top 3 were:

- It has characters or skins that are relevant to my culture, such as local celebrities and sports players.

- It incorporates events relevant to my culture, for example, Mexican Day of the Dead.

- It has content relevant to my culture, such as local maps.

And these top 3 remained consistent for Latin American and US Hispanic gamers, reflecting the fact that they have a distinct culture that they appreciate being incorporated into mobile titles.

Best practices

To address the needs of US Hispanic players, consider:

- Marketing games as “easy to learn” and outlets of relaxation.

- Infusing meaningful Hispanic storylines, characters, and events into mobile games.

- Making it easy for players to socialize with friends with multiplayer features and game invitations.

Principle 3: Consider the broader context of gaming sessions

This principle is about when, where, and why the audience starts playing.

When people play

Both Latin American and US Hispanics gamers see just before bed, afternoon breaks, and the weekend as the top 3 play occasions.

Where people play

There are many similarities in where players played, with 51% of Latin American and US Hispanic gamers playing at home. This finding reflects that both audiences are highly motivated to play games to relax, unwind, and relieve boredom. However, filling time away from home is still a key occasion.

Interestingly, when they’re away from home, many players opt for offline games: 64% of US Hispanic players considered being able to play a game offline important compared to 58% of Latin American players.

Why people play

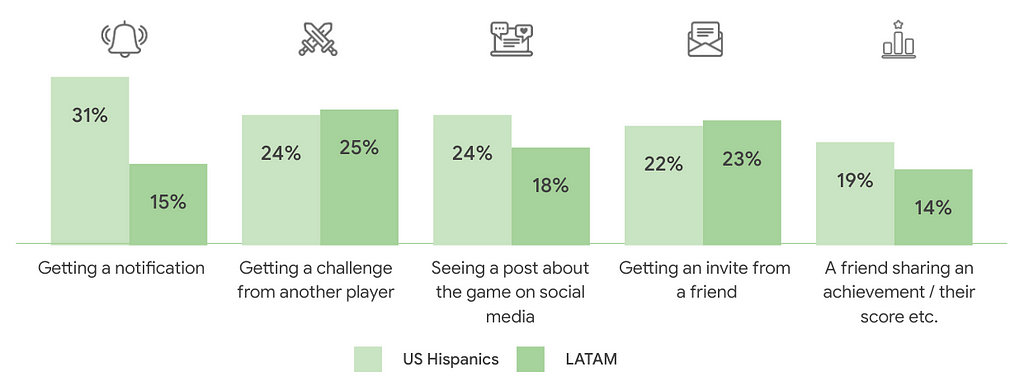

Latin American and US Hispanic gamers are highly social players. Challenges, posts, and invites draw them in. However, US Hispanic gamers are much more likely to respond to notifications. The top gaming triggers broke down like this:

Best practices

To address the needs of US Hispanic players, consider:

- Sending notifications in the afternoons, before bed, and at the weekend to nudge play.

- Providing for offline play during sessions, where possible.

- Incorporating social components into gameplay, make it easy for players to send and accept game challenges and share their progress on social media.

Principle 4: Have a presence across the discovery journey

Players rely on a variety of sources to discover games, presenting both challenges and opportunities.

Where players discover games

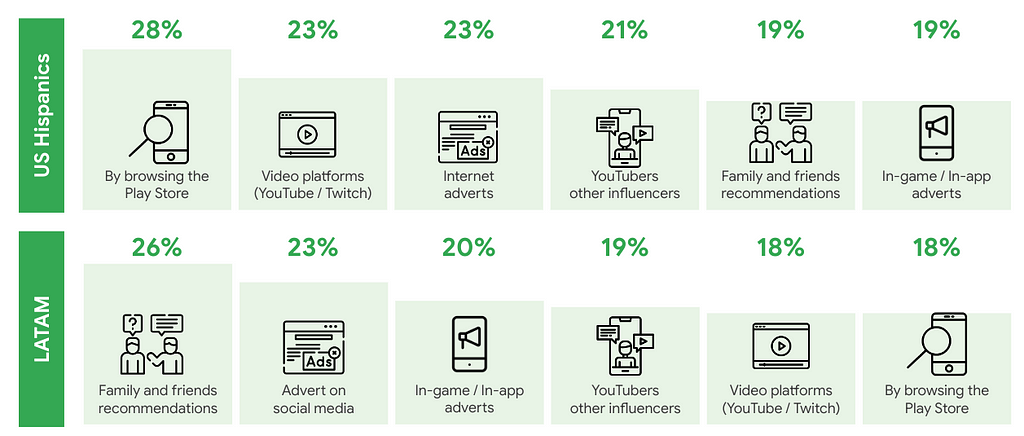

The most used ways to discover games across the two markets were:

For US Hispanic players, Play Store and video platforms are the key discovery channels, while for Latin American gamers recommendations from friends and family and ads are most important.

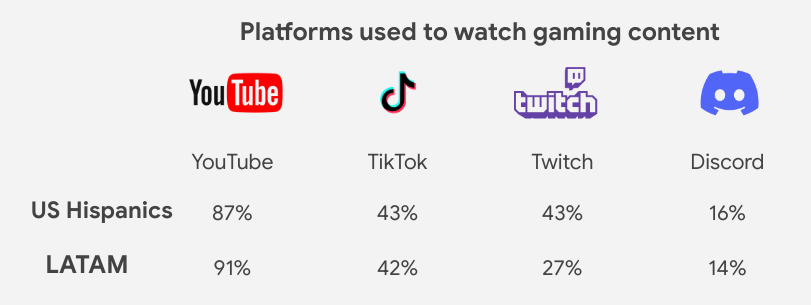

YouTube is used twice as much as other platforms, and the high percentage of gamers using it demonstrates how important it is to have a presence there.

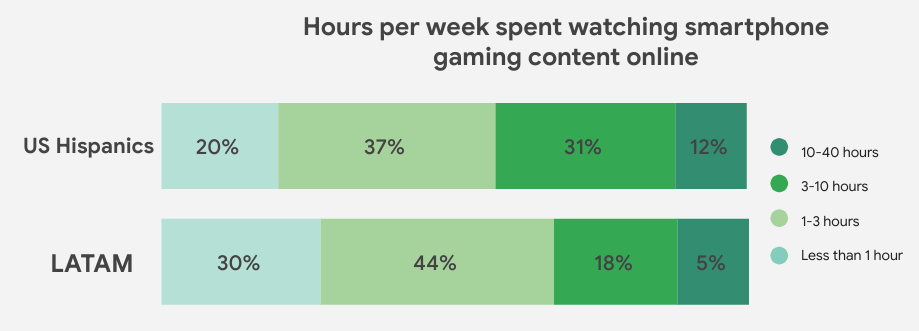

Additionally, nearly half of US Hispanic players watch more than 3 hours of smartphone gaming content online compared to just 23% of Latin American players.

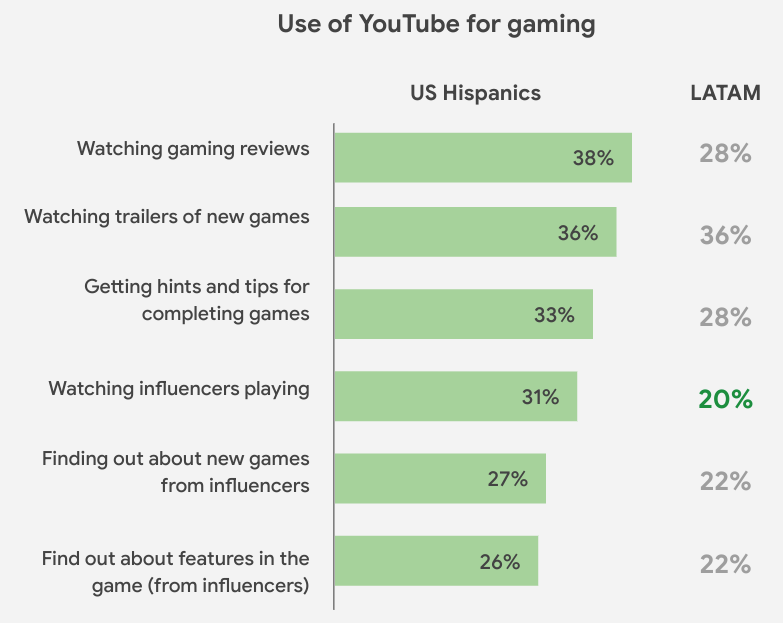

Use of YouTube for gaming

YouTube plays a strong role in both discovering and making the most out of games. Watching game reviews accounts for over a third of Hispanic gaming YouTube use, followed closely by watching trailers of new games.

The impact of influencers

Influencers play a key role in download decisions, with 1 in 4 people among medium and heavyspending US Hispanic gamers having downloaded their most recent game as the result of an influencer recommendation.

Also, as 42% of US Hispanic gamers consume some media in Spanish, it’s likely that these include Spanish-speaking influencers.

Best practices

To address the needs of US Hispanic players, consider:

- Making efforts to be discovered across multiple channels.

- Ensuring you have a strong YouTube presence.

- Using Spanish-speaking influencers for more than just promotion.

Principle 5: Understand local purchase drivers and barriers

The US Hispanic market is significant. According to the Latino Donor Collaborative, based on estimates of GDP, the US Latino market was the equivalent of the world’s 5th largest economy and has grown faster than non-Latino markets in the US.

The survey looked at a number of factors related to spending: who spends, how much they spend, what they buy, and spending behavior.

Spender profiles

Spender profile is fairly uniform among Latin American and US Hispanic gamers, with spenders:

- More likely to be male (62%).

- 3 in 4 or more are aged 25 or older.

- More affluent and have higher average household incomes.

- More likely to find or discover mobile games from YouTubers or gaming influencers and video platforms.

- Driven by social, they will spend to make playing with friends a better experience or to compete with others.

Spending

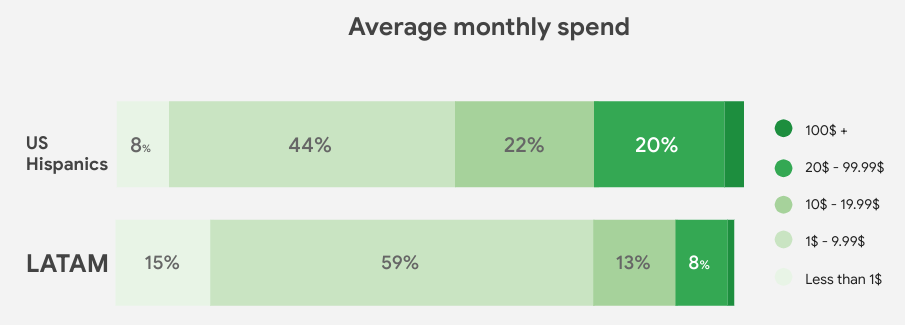

US Hispanic gamers are open to spending on games, though they tend to spend relatively small amounts. 73% of US Hispanic players have spent on IAPs in the past 3 months compared to 58% of Latin American players.

What they buy

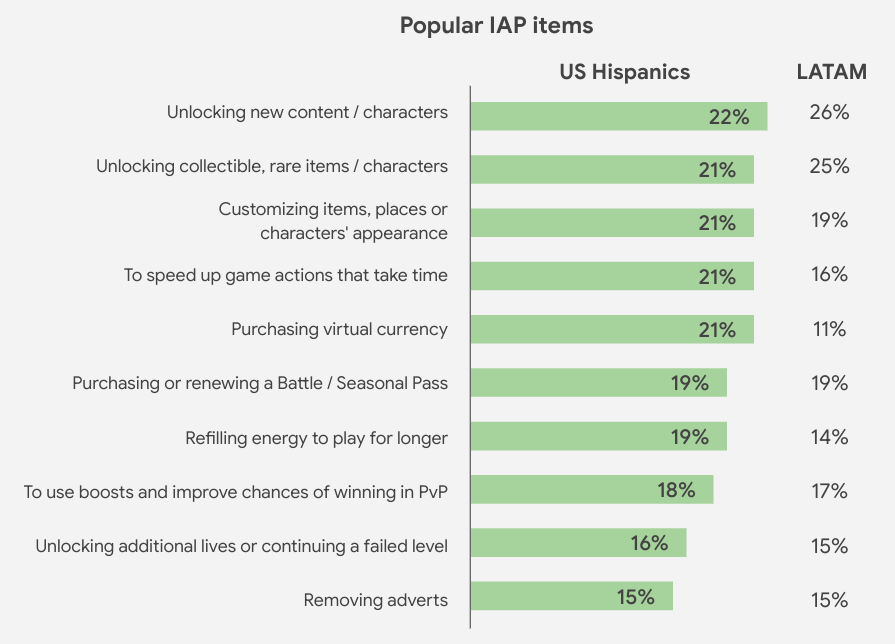

When spending on games players opt for more tangible IAPs, such as those unlocking new characters or collectible items, as they are a lasting and visible reminder of investment.

Spend drivers

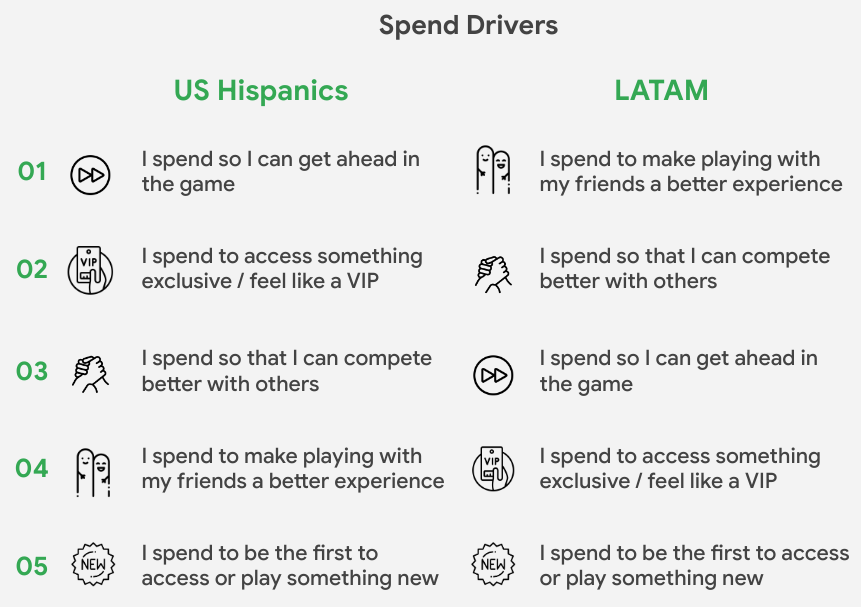

Again there is considerable similarity between the two markets when it comes to spending drivers. However, Latin American players continue to focus on the social aspects of gaming compared to the US Hispanic gamers who are more focused on progression. The top spending drivers for the two audiences are:

Perceptions of value

Cost and value perception are key considerations for US Hispanic gamers:

- 37% didn’t purchase a game because the IAP price was too high (vs 31% of Latin American players).

- 28% didn’t purchase a game because they were worried it wouldn’t be good value (vs 24% of Latin American players).

- 26% didn’t purchase a game because the overall game was too expensive (vs 25% of Latin American players).

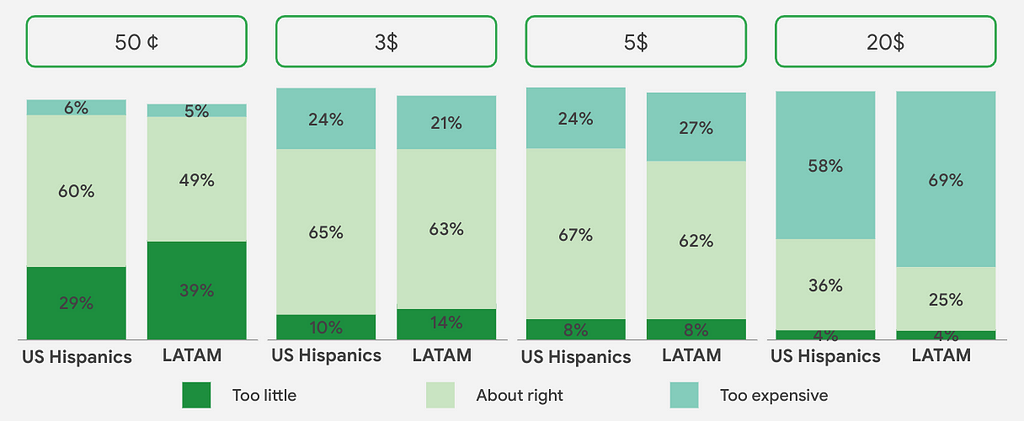

Pricing

About 65% of US Hispanic gamers said that price points between $3 and $5 are “about right” for IAPs.

Motivating non-spenders

Sixty percent of non-spenders said they could be influenced to buy in-app purchases in the future, but need to feel like they’re gaining something valuable from their purchase. Overall, the top 5 reasons for spending were:

- If the IAP was on offer or discounted.

- If the purchase felt like good value, for example, there’s a bonus included.

- If they could progress in the game.

- If they could personalize their experience.

- If they could play the game for longer.

Again, US Hispanic players want to get the most out of their gaming experience, and if that can be enhanced with an in-app purchase, they’re willing to spend.

Best practices

To address the needs of US Hispanic players, consider:

- Emphasizing the value delivered with durable IAPs.

- Ensuring all IAPs make players feel their purchases are great value.

- Set entry price points to meet market expectations.

Reaching US Hispanic gamers

With these 5 principles for success in mind, let’s consider what you should do to reach US Hispanic gamers.

Build US Hispanic players into your Latin America strategy

The experience of successful game businesses suggests this is a three-step process:

1. Test and learn — Launch beta versions of a localized game in specific Latin America markets, with:

- Beta testing that targets specific markets.

- Use of Android Vitals to understand performance on lower-end devices.

2. Optimize — Expand across Latin America, optimizing based on user feedback, with:

- A/B testing and experiments.

- Analysis of ratings and reviews by device type and country.

3. Expand — When you have a high-quality localized game, expand to target Hispanic users in the US by:

- Setting up custom Play store listings in the US for users that have the device set for Spanish.

- Running UA campaigns targeting specific groups.

Tips for reaching Hispanic and Latino people in the US

- Use the right identifying language — Not all Latinos identify as “Hispanic” and not all Hispanic people identify as “Latino,” reflect nuance across Latino experiences.

- Represent the diversity of ethnicities among Latinos — Be mindful of ethnic origin, racial identification, and geographic specificity.

- Show year-round commitment — Showing meaningful representation in creative and product demonstrates a commitment to Latino inclusion.

- Reflect nuance across Latino experiences — Portray nuanced representations of appearances, and socioeconomic and immigrant experiences.

- Avoid appropriating Latino culture — Champion the people behind customs and traditions.

- Ensure localization is handled by native speakers — Spanish speakers hail from a variety of heritages with different vocabulary, dialects, or accents.

Succeed with US Hispanic gamers was originally published in Google Play Apps & Games on Medium, where people are continuing the conversation by highlighting and responding to this story.

What's Your Reaction?