Data and Insights Into Mobile Gamers in Western Europe

This article is part of a collaboration between Newzoo and Google. All market sizing estimates and forecasts in this article are based on Newzoo’s January 2022 update of the Global Games Market Report.Western Europe is the third-largest mobile gaming market by revenues (after Eastern Asia and North America), generating over $7 billion from consumer spending in 2021. This article shares some of our Global Games Market Report data on this exciting market and zooms in on our Consumer Insights data on demographics, spending, favorite genres, and game content viewing behavior among mobile gamers in Western Europe.Mobile Gamer Numbers in Western EuropeBy the end of last year, Western Europe was home to almost 209 million mobile gamers. Based on the January 2022 update of our Global Games Market Report, player growth in Western Europe is forecast to outstrip other mature mobile games markets. Our forecast suggests that between 2019 and 2024, the number of mobile gamers in Western Europe will

This article is part of a collaboration between Newzoo and Google. All market sizing estimates and forecasts in this article are based on Newzoo’s January 2022 update of the Global Games Market Report.

Western Europe is the third-largest mobile gaming market by revenues (after Eastern Asia and North America), generating over $7 billion from consumer spending in 2021. This article shares some of our Global Games Market Report data on this exciting market and zooms in on our Consumer Insights data on demographics, spending, favorite genres, and game content viewing behavior among mobile gamers in Western Europe.

Mobile Gamer Numbers in Western Europe

By the end of last year, Western Europe was home to almost 209 million mobile gamers. Based on the January 2022 update of our Global Games Market Report, player growth in Western Europe is forecast to outstrip other mature mobile games markets. Our forecast suggests that between 2019 and 2024, the number of mobile gamers in Western Europe will grow with a compound annual growth rate (CAGR) of +2.3% compared to +0.8% in North America and +2.2% in Eastern Asia.

The global growth rate is higher (+4.4% 2019–2024 CAGR), thanks to high growth in emerging markets such as Southeast Asia, Latin America, India, and the Middle East & Africa. It’s important to note that Western Europe’s large number of (high) spenders means its revenues are more significant.

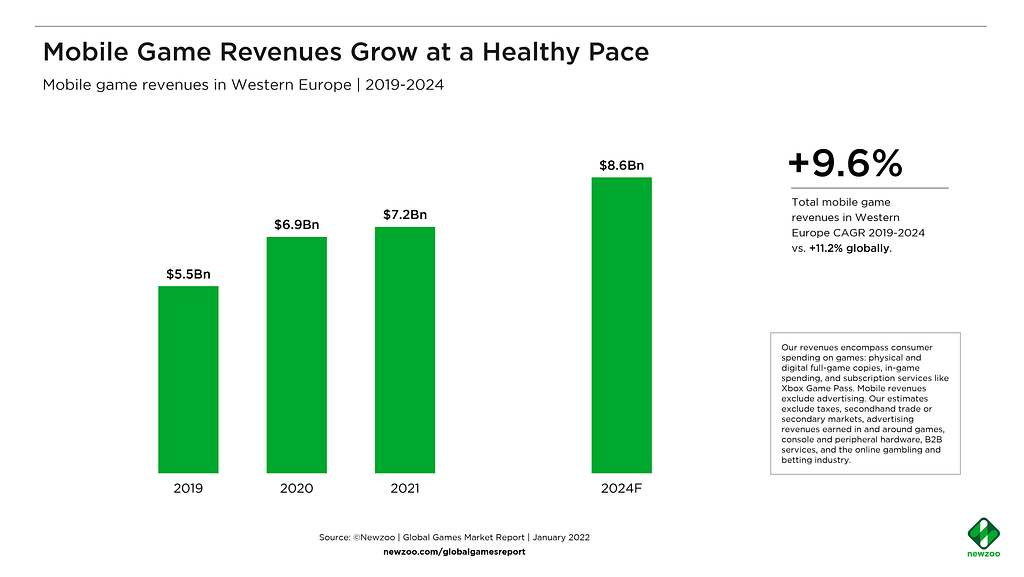

Mobile Game Revenues in Western Europe

In Western Europe, mobile games generated $7.2 billion in revenue from consumer spending in 2021 (excluding ad revenues). While revenues still grew between 2020 and 2021, growth was slower than in the previous period.

Mobile’s revenue slowdown from 2020 to 2021 was not unique to Western Europe. Across the board, 2020 was a monumental year for gaming, which attracted many new and returning players due to COVID lockdowns.

Western Europe’s mobile games market is healthy, as is illustrated by Western Europe’s continued growth in mobile revenue and player numbers across 2020 and 2021, despite the impact on user acquisition on iOS due to Apple’s removal of IDFA in Q2 2021 and COVID-related challenges. Android mobile gaming in Western Europe continued to see stable growth last year for several reasons:

- As the world opened up and players emerged from lockdowns, mobile gaming on pocket-sized devices maintained healthy growth in engagement and spending.

- Revenue growth on Android was more fruitful because of the impact on iOS game developers of Apple’s removal of IDFA. Western Europe is more Android-focused than other mature Western markets, including the U.S., so avoided the adverse knock-on effects of this change. In fact, 55% of Western Europe’s mobile gaming revenue came from Android vs 35% in North America.

More Growth Is on the Horizon for Western Europe’s Mobile Games Market

Western Europe’s mobile games market will grow even more in the long-term, hitting $8.6 billion in 2024. This growth will be driven by:

- Ongoing live services and hybrid monetization innovation (across core and casual genres).

- Console- and PC-first companies bringing their franchises to mobile to bolster their growth and revenue streams. For example, Apex Legends Mobile and Diablo Immortal launched on mobile this year.

- Mobile games getting increasingly complex and immersive, attracting core gamers to the platform and boosting revenues.

- Opportunities to boost average spend per mobile gamer, which is relatively low compared to console games in the region and mobile games in other mature markets.

- A new generation of mobile-first gamers (for instance, ROBLOX reported 54% of its revenue coming from mobile in 2021).

That’s our high-level overview of Western Europe’s games market, but who are the players that power it? What are their demographics? And how much do they spend? Let’s take a look.

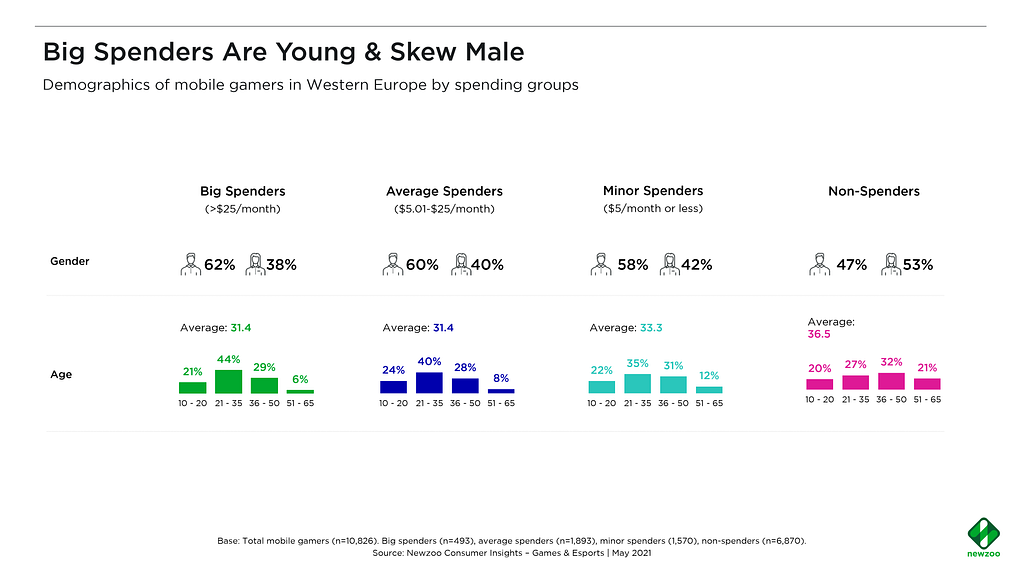

Male Mobile Gamers in Western Europe Are More Likely to Spend Big

To explore Western Europe’s player behavior and motivations, we surveyed more than 10,000 mobile gamers in France, the U.K., Germany, Italy, Spain, the Netherlands, Belgium, Sweden, and Finland. We categorize Western Europe’s mobile gamers into four spending groups:

- Big spenders, who spend over $25 a month across mobile games.

- Average spenders, who spend between $5.01 and $25 a month.

- Minor spenders, who spend $5 a month or less.

- Non-spenders, who spend nothing on mobile games.

The bigger the spending group, the more likely it is to be male-dominated. As you can see below, 62% of big spenders are male compared to 60% of average spenders, 58% of minor spenders, and 47% of non-spenders:

The more players spend, the younger they are. Big and average spenders have an average age of 31.4 compared to 33.3 for minor spenders and 36.5 for non-spenders.

Unsurprisingly, big spenders tend to be the players engage most with the game (and therefore spend more time playing). We cross-analyzed their playing behavior with spending habits, and the results speak for themselves:

- Nearly 70% of big spenders play more than three days a week compared to less than 50% for the other groups.

- 53% of big spenders play longer than 6 hours a week on mobile, compared to only 20% for the others.

Naturally, some genres take up more of players’ time than others.

Complex, Competitive, and Core: Big Spenders on Mobile Tend to Play More Intricate Genres

We asked mobile gamers in Western Europe which genres they played most in the past six months. The biggest spenders tended to list more core and complex genres such as shooter, adventure, fighting, battle royale, and role-playing games. Casual genres, such as puzzle, are more prominent among the non-big spending groups — those who spend no more than $25 per month on mobile games.

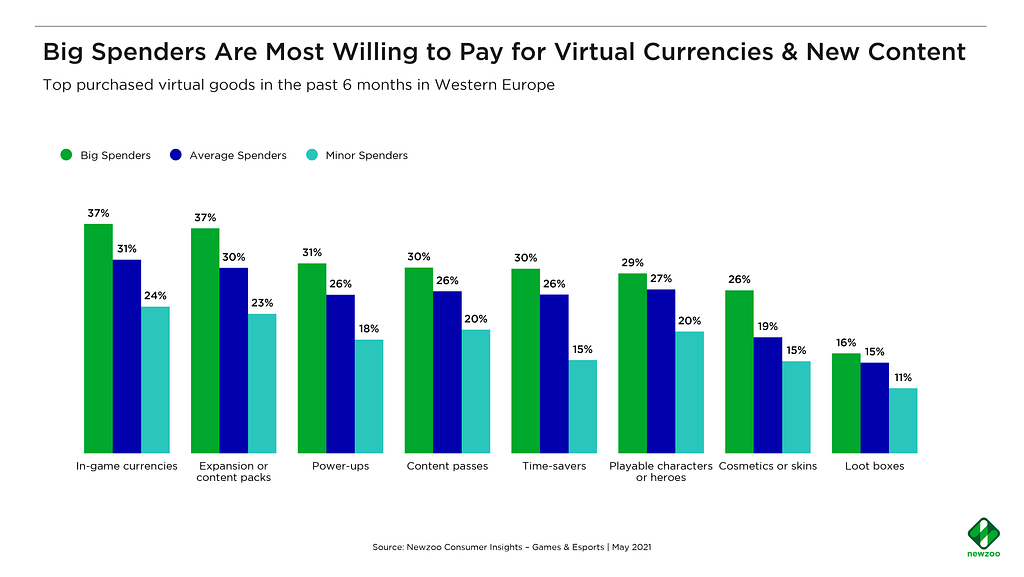

Naturally, these genre preferences are visible in the types of content mobile gamers buy.

Big spenders are more likely to spend on every category. Relative to other groups, spending on cosmetics and skins is more common among big spenders. This is, at least in part, because the casual genres enjoyed by average and minor spenders have fewer options to buy cosmetics and skins. Rather, in-game microtransactions in casual games are mainly for extra lives, moves, and power-ups.

As you can see above, big spenders and average spenders also show a stronger preference for in-game currencies, new content, power-ups, content passes, and time savers.

Content passes, such as season passes and battle passes in particular, are becoming increasingly popular among mobile games, giving publishers a predictable recurring revenue stream. Such monetization is now a staple of Western Europe’s most popular core mobile games, including Call of Duty Mobile and Clash of Clans.

YouTube Is by Far the Most Popular Streaming Platforms Among Mobile Gamers

Western Europe’s esports scene generated $209.6 million in revenues in 2021, powered by an esports audience of 47.0 million. The live-streaming audience — those who have watched live-streamed gaming content at least once in the last six months — reached 91.3 million in 2021.

Engagement with game streaming content is high among mobile gamers in Western Europe. Based on our consumer insights, 45% of mobile gamers watch live-streamed game content. The same share watches pre-recorded game content.

YouTube is by far the most popular game streaming platform among mobile gamers in Western Europe. Among those who watch game content, over 90% report that they watch more than once a week on YouTube. Meanwhile, rivals — including Twitch, Facebook, Twitter, and TikTok — each get 50–60% of viewers watching more than once a week.

If you’d like to learn more about the mobile games market in Western Europe, reach out to us here or at questions@newzoo.com.

https://medium.com/media/0e85201ea4040dbd11cc57ca54227ade/hrefData and Insights Into Mobile Gamers in Western Europe was originally published in Google Play Apps & Games on Medium, where people are continuing the conversation by highlighting and responding to this story.

What's Your Reaction?